Browsing the Needs for Getting Bid Bonds Successfully

Browsing the Needs for Getting Bid Bonds Successfully

Blog Article

Necessary Steps to Make Use Of and obtain Bid Bonds Efficiently

Navigating the complexities of bid bonds can substantially affect your success in securing agreements. The genuine obstacle exists in the meticulous choice of a reputable company and the calculated utilization of the quote bond to boost your affordable side.

Understanding Bid Bonds

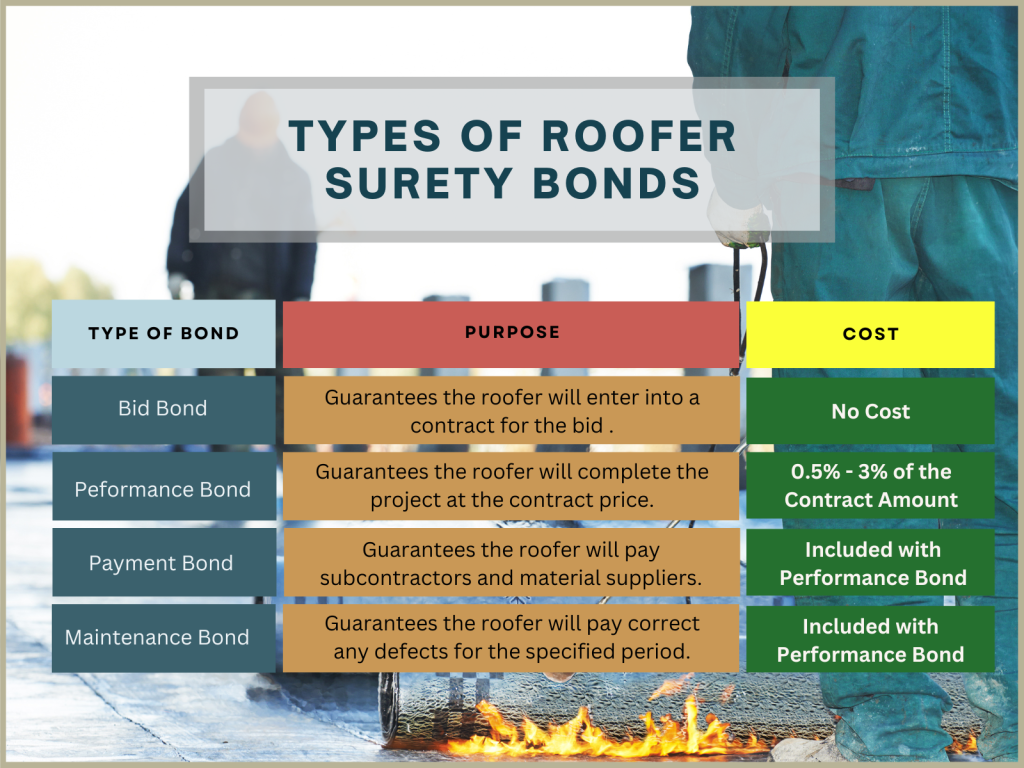

Bid bonds are a vital element in the building and having market, functioning as an economic assurance that a bidder intends to enter right into the agreement at the bid price if granted. Bid Bonds. These bonds reduce the danger for job proprietors, making certain that the selected service provider will certainly not just honor the quote yet also safe and secure performance and payment bonds as required

Basically, a quote bond serves as a safeguard, shielding the task proprietor against the financial effects of a service provider stopping working or taking out a bid to start the job after selection. Typically provided by a surety business, the bond warranties payment to the owner, typically 5-20% of the bid amount, should the service provider default.

In this context, bid bonds cultivate an extra credible and competitive bidding process atmosphere. They compel professionals to present practical and serious bids, knowing that a monetary charge towers above any type of breach of commitment. Moreover, these bonds make sure that just solvent and credible contractors participate, as the rigorous qualification procedure by guaranty firms displays out less reputable bidders. Quote bonds play an essential function in keeping the integrity and smooth procedure of the building bidding process.

Getting Ready For the Application

When preparing for the application of a bid bond, precise company and detailed paperwork are paramount. An extensive evaluation of the task requirements and proposal needs is important to guarantee compliance with all terms.

Following, put together a listing of previous jobs, specifically those comparable in extent and dimension, highlighting effective conclusions and any type of qualifications or honors obtained. This profile offers as evidence of your business's ability and reliability. Additionally, prepare a comprehensive company plan that details your functional approach, danger administration methods, and any contingency intends in area. This strategy offers a holistic view of your firm's technique to job execution.

Make certain that your company licenses and registrations are current and easily offered. Having these records organized not just speeds up the application procedure however also forecasts a professional photo, instilling confidence in possible surety suppliers and job proprietors - Bid Bonds. By systematically preparing these components, you position your firm favorably for effective proposal bond applications

Discovering a Guaranty Service Provider

In addition, consider the supplier's experience in your specific market. A guaranty company aware of your area will much better recognize the distinct dangers and needs related to your jobs. Demand references and inspect their background of cases and client fulfillment. It is additionally recommended to review their economic rankings from agencies like A.M. Finest or Criterion & Poor's, guaranteeing they have the financial strength to back their bonds.

Engage with multiple service providers to compare solutions, terms, and prices. An affordable analysis will certainly aid you safeguard the ideal terms for your proposal bond. Inevitably, a detailed vetting procedure will certainly make sure a trustworthy collaboration, promoting confidence in your bids and future projects.

Sending the Application

Sending the application for a quote bond is a vital step that requires meticulous attention to information. This procedure begins by gathering all pertinent documents, consisting of financial statements, task specs, and an in-depth company history. Making certain the precision and completeness of these documents is extremely important, as any type visit site of discrepancies can lead to hold-ups or beings rejected.

When filling out the application, it is recommended to confirm all entrances for accuracy. This includes verifying figures, ensuring proper signatures, and confirming that all needed accessories are included. Any errors or omissions can weaken your application, triggering unnecessary complications.

Leveraging Your Bid Bond

Leveraging your proposal bond efficiently can dramatically enhance your affordable side in securing agreements. A proposal bond not only demonstrates your economic stability but likewise reassures the project proprietor of your dedication to fulfilling the contract terms. By showcasing your quote bond, you can underscore your firm's reliability and integrity, making your proposal stand apart among countless rivals.

To leverage your quote bond to its maximum possibility, guarantee it is presented as part of a detailed quote plan. Highlight the toughness of your surety service provider, as this shows your business's economic wellness and functional ability. Additionally, emphasizing your record of successfully completed projects can even more impart confidence in the job owner.

Furthermore, preserving close communication with your surety company can assist in much better conditions in future bonds, therefore strengthening your competitive positioning. A proactive approach to managing and restoring your proposal bonds can also prevent lapses and ensure continuous insurance coverage, which is essential for recurring task purchase efforts.

Conclusion

Effectively using and obtaining proposal bonds requires extensive preparation and critical execution. By comprehensively arranging essential documentation, picking a respectable surety copyright, and sending a complete application, companies can secure the essential quote bonds to enhance their competition. Leveraging these bonds in proposals highlights the have a peek at this site firm's integrity and the strength of the guaranty, ultimately boosting the possibility of safeguarding contracts. Continual communication with the guaranty provider makes sure future opportunities for effective task quotes.

Determining a trustworthy surety company is an important action in securing a quote bond. A quote bond not just shows your economic security but also assures the job proprietor of your dedication to meeting the agreement terms. Bid Bonds. By showcasing your proposal bond, you can underline your firm's reliability and trustworthiness, making your quote recommended you read stand out among many rivals

To utilize your proposal bond to its greatest possibility, guarantee it is offered as component of a thorough proposal plan. By adequately arranging crucial documents, choosing a credible guaranty copyright, and submitting a total application, companies can safeguard the essential quote bonds to enhance their competitiveness.

Report this page